Configure account categories for financial reporting

Common account types

ZAP’s financial calculations and analytics rely on a list of pre-defined ‘Common Account Types’, which can be found in a Unified Layer enabled model’s ‘Common Chart Mapping’ data source. Once a Unified Layer enabled solution is deployed and the account types are correctly mapped, all ZAP Financial analytics and dashboards will report and work across companies and charts of accounts.

The Common Account Type (looked up from the embedded Common chart mapping spreadsheet) maps your ERP’s categorization of accounts (this can be groups, categories, classes, etc) to Common Account Types. These are then used as foreign keys in relevant pipelines, therefore remapping should not be required.

Common chart mapping spreadsheet

To view the current Common Account Category mapping, or to add mappings for reporting:

Download the ‘Common chart mapping’ spreadsheet from the model so you can edit it.

The spreadsheet has two tabs, ‘CommonCoA’ and ‘SourceMapping’.

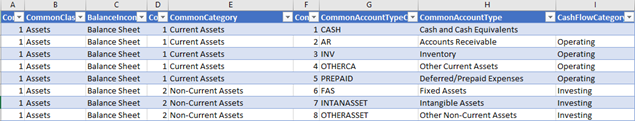

CommonCoA tab

This tab contains a list of pre-defined account types that can be used to map your account groups or accounts to. This sheet contains different generic categorizations of accounts in a typical enterprise application or accounting software, such as Classes, Categories, and Types. Each of these classifications has its own granularity which is useful for reporting.

|

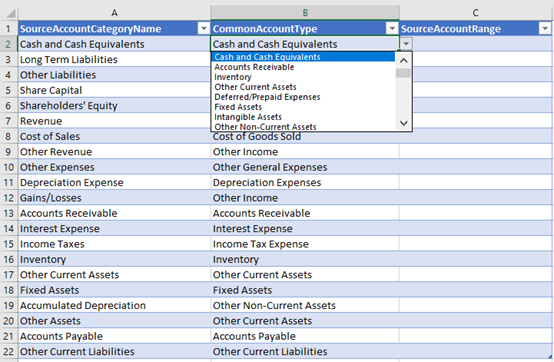

SourceMapping tab

This tab by default contains the mapping of your ERP’s categorized accounts to the specified ‘CommonAccountType’ found on the CommonCoA tab. Map additional groupings (under the ‘SourceAccountCategoryName’ header) to Common Account Types (under the ‘CommonAccountType’ header) by selecting a type from the drop-down box:

|

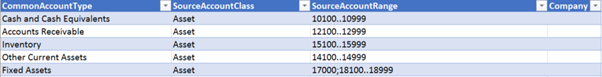

If it is not appropriate to use account categorizations such as groups, categories, classes (your ERP may not support this or it is not used), it may be possible to map account ranges to Common Account Types instead:

|

In this case, account ranges are associated with Common Account Types. For example, ‘Cash and Cash Equivalents’ is represented by accounts between 10100 and 10999 inclusive.

Different chart of accounts per company

For ERP’s in which the chart of accounts is not shared, the Company column in the ‘SourceMapping’ spreadsheet can be used to specify each company’s chart of accounts. That is, multiple charts of accounts may be mapped in the ‘SourceMapping’ spreadsheet, and these can be per company or shared.

When the Company column is specified, mapping to the Common Chart for that Company alone is used.

When the Company column is unspecified, generic mapping (where Company value is unspecified) is used.

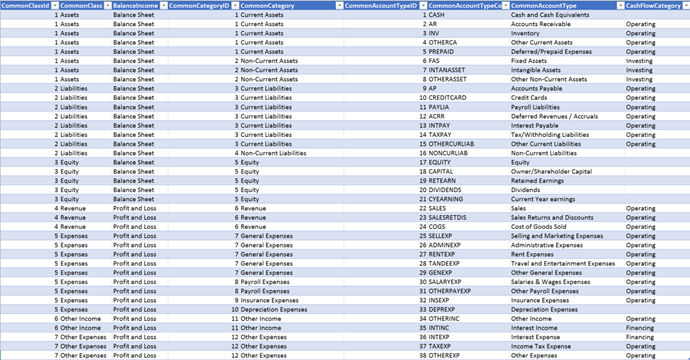

Common account types list

Outlined below are the Common account types with a brief description, and the method to map your chart of accounts.

|

Most calculated members in the analytics have the same name as the Common Account Type. Shown below are the accounts typically mapped to each Account category:

Cash and Cash Equivalents

Maps to any Cash & Cash Equivalents accounts of your chart of accounts such as Bank accounts, Credit card bank accounts, Petty cash and Funds not deposited and is mapped in the ‘Current Assets’ calculation.

Accounts Receivable

Maps to any Accounts Receivable accounts of your chart of accounts such as Accounts receivables, Other receivables, Inter-Company receivables, Inter-Company due from, Shipped not invoiced clearing, Supplier credit memo received and Allowance for doubtful accounts and is mapped in the ‘Current Assets’ calculation.

Inventory

Maps to any Inventory accounts of your chart of accounts such as Inventory – Raw materials, Work in progress, Finished goods and In transit accounts and is mapped in the ‘Current Assets’ calculation.

Other Current Assets

Maps to any Other current asset accounts of your chart of accounts that does not include the major current assets such as Cash, Accounts receivable, Inventory and Prepaid expenses and is mapped in the ‘Current Assets’ calculation.

Deferred/Prepaid Expenses

Maps to any Deferred or Prepaid Expenses accounts of your chart of accounts such as Prepaid expenses, Prepaid income taxes and Prepaid insurance and is mapped in the ‘Current Assets’ calculation.

Fixed assets

Maps to any Fixed Asset accounts of your chart of accounts such as Property, Plant and Equipment and is mapped in the ‘Non Current Assets’ calculation.

Intangible Assets

Maps to any Intangible Asset accounts of your chart of account such as patents, trademarks, copyrights, and customer lists and is mapped in the ‘Non Current Assets’ calculation.

Other Non-Current Assets

Maps to any Other current asset accounts of your chart of accounts such as Long-term investments, Goodwill etc. and is mapped in the ‘Non Current Assets’ calculation.

Accounts Payable

Maps to any Accounts Payable accounts of your chart of accounts such as Accounts payables, Received not invoiced clearing, Expense payables, Customer credit memo payables, Inter-Company payables and Inter-Company due to and is mapped in the ‘Current Liabilities’ calculation.

Credit Cards

Maps to any Credit card accounts of your chart of accounts and is mapped in the ‘Current Liabilities’ calculation.

Payroll Liabilities

Maps to any Payroll Liability accounts of your chart of accounts such as Payroll taxes and is mapped in the ‘Current Liabilities’ calculation.

Deferred Revenues / Accruals

Maps to any Other Current Liability accounts of your chart of accounts such as Accrued interest expense, Accrued payroll taxes, Accrued pension liability, Accrued services, Accrued wages and other short-term liabilities and is mapped in the ‘Other Current Liabilities’ calculation.

Interest Payable

Maps to any Other Current Liability accounts of your chart of accounts such as Billed or Accrued Interest and is mapped in the ‘Other Current Liabilities’ calculation.

Tax/Withholding Liabilities

Maps to any Tax withholding accounts of your chart of accounts and is mapped in the ‘Other Current Liabilities’ calculation.

Other Current Liabilities

Maps to any Other Current Liability accounts of your chart of accounts, which aggregates several current liability accounts that are too minor to report separately and is mapped in the ‘Other Current Liabilities’ calculation.

Non Current Liabilities

Maps to any Non Current Liabilities accounts of your chart of accounts such as Long term loans.

Equity

Maps to any Equity account of your chart of accounts such as Common stock, Preferred stock, Additional paid-in capital, Treasury stock, Shareholder’s investment, Revaluation and other reserves and Retained earnings.

Owner/Shareholder Capital

Maps to any Equity account of your chart of accounts, which includes Owner’s investments, net income earned.

Retained Earnings

Maps to any Equity account of your chart of accounts, which includes the profits that a company has earned to date.

Dividends

Maps to any Equity account of your chart of accounts, which includes payment to shareholders of a portion of the earnings.

Current Year earnings

Maps to any Equity account of your chart of accounts, which includes profit earned in the current year.

Sales

Maps to any revenue accounts such as Sales revenue, Finance charge income, Shipping charges and insurance.

Sales Returns and Discounts

Maps to any Discounts, returns and allowances accounts of your chart of accounts such as Sales returns and allowances and Sales discounts.

Cost of Goods Sold

Maps to any COGS accounts of your chart of accounts such as Cost of sales, Commission, Freight charges, Equipment rental, Variances, Subcontracted services, Absorbed costs (Labor, Machine, Overhead, Subcontracting etc.), WIP balancing and scrap and Direct labor costs.

Selling and Marketing Expenses

Maps to any Selling and Marketing expense accounts of your chart of accounts such as Salesperson salaries and wages, Commissions, Benefits, Advertising etc. and is mapped in the ‘Operating Expenses’ calculation.

Administrative Expenses

Maps to any Administrative expense accounts of your chart of accounts, which includes general staff costs, head office expenses and general insurance and is mapped in the ‘Operating Expenses’ calculation.

Rent Expenses

Maps to any Rent expense accounts of your chart of accounts that lists the cost of occupying rental properties and is mapped in the ‘Operating Expenses’ calculation.

Travel and Entertainment Expenses

Maps to any Travel and Entertainment expense accounts of your chart of accounts that lists incidental expenses associated with business travel and is mapped in the ‘Operating Expenses’ calculation.

Other General Expenses

Maps to any Interest Paid accounts of your chart of accounts, which includes Office supplies, Telephone, Utilities etc. and is mapped in the ‘Operating Expenses’ calculation.

Salaries & Wages Expenses

Maps to any Salaries and Wages accounts of your chart of accounts and is mapped in the ‘Operating Expenses’ calculation.

Other Payroll Expenses

Maps to any Other Payroll expense accounts of your chart of accounts which excludes salaries and wages and is mapped in the ‘Operating Expenses’ calculation.

Insurance Expenses

Maps to any Insurance expense accounts of your chart of accounts and is mapped in the ‘Operating Expenses’ calculation.

Depreciation Expenses

Maps to any Depreciation expense accounts of your chart of accounts.

Other Income

Maps to any Other Income accounts of your chart of accounts.

Interest Income

Maps to any Interest Income accounts of your chart of accounts and is mapped in the ‘Interest’ calculation.

Interest Expense

Maps to any Interest Expense accounts of your chart of accounts such as Discounts earned and Interest income or expenses and is mapped in the ‘Interest’ calculation.

Income Tax Expense

Maps to any Income tax expense accounts of your chart of accounts and is mapped in the ‘Taxes’ calculation.

Other Expenses

Maps to any Other Expenses accounts of your chart of accounts.

Financial statements

If financial statements or general ledger metrics return incorrect figures, you must confirm that the mapping of Account ranges or Groups/Categories to the Common Chart is correct in the ‘Common Chart mapping’ spreadsheet.

If any changes have been made, save the spreadsheet and upload it back to the model. Perform a full process on your model.